***For SMB Government Contractors who need a full service Lending & Payment provider.***

The Ai-Enabled Lending & Payment Partner That Is Transforming

SMB GovCon Financing

Leveraging Ai To Transform

SMB GovCon Payments & Lending

WHAT WE OFFER

We transform fixed-prime government contracts into

fair & affordable working capital for SMB Government Contractors.

What industry leaders are saying...

TERM LOANS

$100,000 to $1,000,000+

Up to 20% of un-billed contract value

Gap Financing

Mobilization Capital

LINES OF CREDIT

$100,000 to $1,000,000+

Up to 90% advance rate

Funds available on Day 1*

Access funds based on your needs

*Contingent on start date of government contract.

BORROWER BENEFITS

Affordable low rates

No personal guarantees

Execute contract with greater confidence

$260 Application fee**

**Application Fee NOT charged until after you've been pre-qualified.

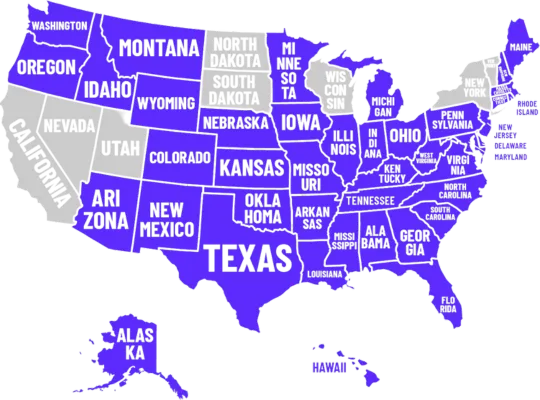

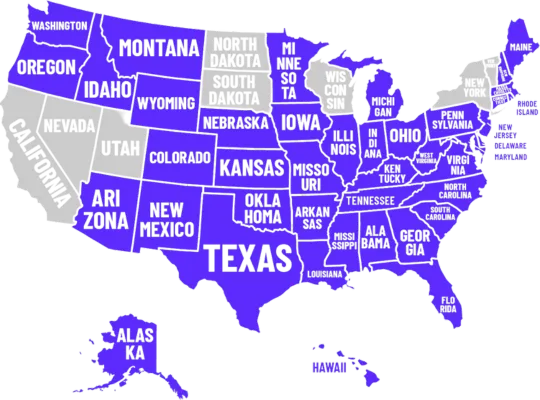

WHERE WE OPERATE

We offer financing in 42 of the 50 states.

WHY WE'RE FASTER

Designed to enable SMB government contractors the ability execute

with speed and confidence.

Watch the 2 minute video of OppZo's Registration process

Watch the 2 minute video for OppZo's Registration process

OUR ECOSYSTEM

We are building an ecosystem of partners committed to driving

public and private capital into SMB GovCon businesses.

WHAT OTHERS ARE SAYING

Why SMB GovCons are partnering with OppZo...

FREQUENTLY ASKED QUESTIONS

Join our dynamic ecosystem today and accelerate your business potential. By registering today, you will expedite the loan application and funding process, and gain access to a range of exciting benefits.

What states are you operating in?

We operate in all US States except the following: California, Nevada, New York, North Dakota, South Dakota, Utah, Vermont, Wisconsin

We also do not offer services in any US Territories, including: American Samoa, Federated States of Micronesia, Guam, Marshall Islands, Northern Mariana Islands, Puerto Rico, and Virgin Islands.

What determines the rate? Is this fixed rate or floating rate?

It depends on the risk level of the contract and your company, as well as the type of financing vehicle.

Is OppZo a bank?

No, we are a non-bank lender.

Do you have any thing that resembles a line of credit?

We offer a customizable line of credit product. If you’d like to learn more, simply click the chat icon to speak with a member of our team.

What does the registration and application process look like/require?

Please visit https://www.aionfi.com/partner/oppzo for detailed information.

Ready to Secure Additional Working Capital?

Click the button below to start the Registration Process

OppZo.com | Copyright ©2023 | All Rights Reserved

150 W Flagler StreetMiami Florida 33130

*Depending on the state where your business is located and other attributes of your business and the loan, your business funding may be issued by a member of theOppZo family of companies or by one of our partner institutions. Your funding agreement will identify the funder prior to your signing. Funding subject to approval.

*Additional qualifications apply. See loan application and accompanying instructions for additional required information and qualifications.